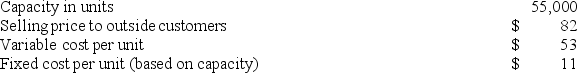

Wetherald Products, Inc., has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:  The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $74 per pump.

The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $74 per pump.

Assume that the Pump Division is selling all of the pumps it can produce to outside customers. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

Definitions:

Scarce Resources

Resources that are limited in availability and can be used for the production of goods and services.

Savers

Individuals or entities that set aside a portion of their income for future use, often in interest-bearing accounts or investments.

Financial Markets

Markets where financial securities, such as stocks and bonds, are issued and traded among investors.

Investment Tax Credit

A tax credit offered to businesses to encourage them to invest in certain assets, reducing their tax liability.

Q5: For performance evaluation purposes, the actual fixed

Q62: Fingado Products, Inc., has a Detector Division

Q73: Royal Products, Inc., has a Connector Division

Q80: A manufacturing company has a standard costing

Q86: Debona Corporation is considering a capital budgeting

Q92: Brull Products, Inc., has a Sensor Division

Q100: Zaccaria Corporation has provided the following contribution

Q132: Schimpf Industries Inc. has developed a new

Q170: One full-time clerical worker is needed for

Q183: When the level of activity decreases within