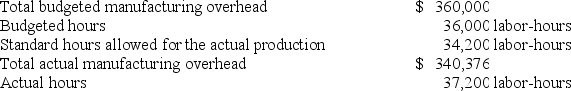

Carattini Incorporated makes a single product-an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:  The total amount of manufacturing overhead applied is closest to:

The total amount of manufacturing overhead applied is closest to:

Definitions:

Variable Costing

An accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in the cost of goods sold.

Absorption Costing

A calculation approach that encompasses all expenses of production, such as materials, labor, and all overheads, both variable and fixed, in determining a product's price.

Variable Production Costs

Costs that vary directly with the level of production, such as raw materials and direct labor.

Absorption Costing

This approach to bookkeeping encompasses all production-associated expenses, including direct materials, direct labor, and all manufacturing overheads, both variable and fixed, in calculating the product's price.

Q7: There can be no volume variance for

Q53: Ganus Products, Inc., has a Relay Division

Q60: Morr Logistic Solutions Corporation has developed a

Q67: Schweiss Corporation is conducting a time-driven activity-based

Q77: Trumbauer Incorporated makes a single product-an electrical

Q90: Bohmker Corporation is introducing a new product

Q139: Within the relevant range, a change in

Q140: Diedrich Corporation makes a product with the

Q254: Advertising is not considered a product cost

Q277: Differential costs can:<br>A) only be fixed costs.<br>B)