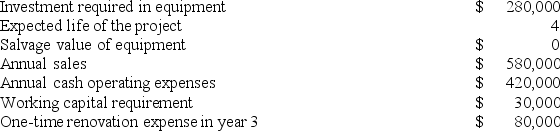

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

Definitions:

Long-Term Debt

Refers to loans or borrowed funds that are to be repaid over a period longer than one year, typically used for significant investments or to fund major projects.

Asset Base

The aggregate of all the resources owned by a person or organization, which can potentially be used to generate income.

Nonbankable Gaps

Funding or credit needs of a business that cannot be met by traditional bank financing, usually requiring alternative sources of capital.

Entrepreneurial Finance

The study and application of financial resources and tools to start, grow, or sustain entrepreneurial ventures.

Q5: Jarvis Corporation is conducting a time-driven activity-based

Q16: Tron Products, Inc., has a Pump Division

Q50: In value-based pricing, the economic value to

Q60: Meers Products, Inc., has a Detector Division

Q86: Eastern Company uses a standard cost system

Q93: Kinsley Corporation manufactures numerous products, one of

Q94: An income statement for Sam's Bookstore for

Q147: The markup over cost under the absorption

Q159: Mark is an engineer who has designed

Q264: At a sales volume of 40,000 units,