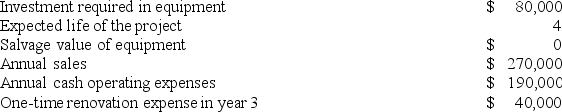

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

Definitions:

Q2: The Downstate Block Company has a trucking

Q12: Coble Woodworking Corporation produces fine cabinets. The

Q16: Most of the opportunities to reduce the

Q21: Streif Inc., a local retailer, has provided

Q33: Sardella Corporation is conducting a time-driven activity-based

Q36: Erkkila Inc. reports that at an activity

Q57: Schlaefer Corporation is conducting a time-driven activity-based

Q59: Hilfiger Industries Inc. has developed a new

Q168: Management of Plascencia Corporation is considering whether

Q197: Mark is an engineer who has designed