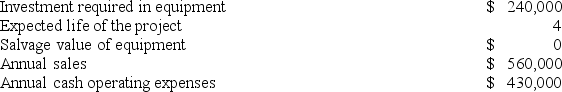

Manjarrez Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 6%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 6%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Fixed Expenses

Costs that do not fluctuate with the level of production or sales within a certain range, such as rent or salaries.

Absorption Costing

A costing technique that encompasses the total expenses of production, including direct materials, labor, and all overhead costs, both variable and fixed, in a product's cost.

Single Product

A business or manufacturing approach where only one type of product is produced rather than multiple products.

Absorption Costing

An accounting method that includes all direct costs and overhead in the cost of a product.

Q3: Boynes Corporation is considering a capital budgeting

Q11: Shanks Corporation is considering a capital budgeting

Q40: The Parts Division of Nydron Corporation makes

Q42: Nealon Corporation's Maintenance Department provides services to

Q58: Liapis Products, Inc., has a Valve Division

Q60: Chojnowski Incorporated makes a single product-a cooling

Q89: A partial listing of costs incurred at

Q90: Vaden Incorporated makes a single product-a critical

Q127: Antinoro Corporation has provided the following information

Q165: Kesterson Corporation has provided the following information: