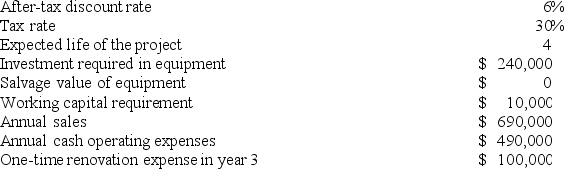

Lafromboise Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Medicaid

A government-funded program in the United States that provides health insurance to low-income individuals and families.

Private Sector Cost

The expense associated with goods, services, or activities delivered by businesses not owned or operated by the government.

Tax Compliance

The act of following and meeting all statutory responsibilities in tax reporting, payment, and documentation by individuals or entities.

Excess Burden

The cost to society created by market inefficiency, often associated with government intervention or taxation that distorts market equilibrium.

Q4: Leslie Company operates a cafeteria for the

Q19: Time-based activity-based costing does not require extensive

Q45: The Marlow Corporation uses a standard cost

Q48: Krueger Corporation is conducting a time-driven activity-based

Q60: Morr Logistic Solutions Corporation has developed a

Q84: Vanzant Corporation has provided the following information

Q132: The fixed manufacturing overhead budget variance equals:<br>A)

Q174: Goolden Electronics Corporation has a standard cost

Q177: The budget variance for fixed manufacturing overhead

Q285: Pedregon Corporation has provided the following information: