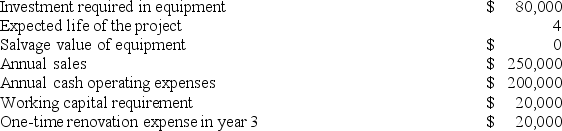

Mulford Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

Definitions:

Geegaws

Inexpensive, showy trinkets or novelty items.

Doodads

Informal term for small, often decorative objects with no specific utility or function.

Type Alpha Employees

A categorization for employees who are highly motivated, confident, and capable of independent work.

Type Beta Employees

A categorization in a theoretical model that may refer to a certain group of employees characterized by specific attributes or behaviors, commonly seen in psychological or economic models.

Q19: Feauto Manufacturing Corporation has a traditional costing

Q40: If the formula for the markup percentage

Q41: Herrell Corporation manufactures numerous products, one of

Q48: Union Corporation manufactures and sells one product.

Q58: Algood Corporation manufactures numerous products, one of

Q66: The management of Hamano Corporation would

Q93: The manufacturing overhead variance that is a

Q101: An unfavorable volume variance means that the

Q102: Prudencio Corporation has provided the following information

Q109: Imbesi Corporation is conducting a time-driven activity-based