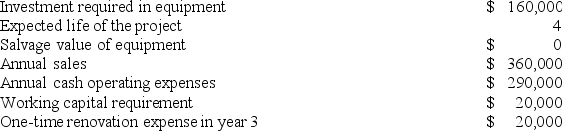

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Yearly Payment

An amount of money that is paid once every year, often related to loans, leases, or other financial agreements.

Interest Rate

The amount charged by lenders to borrowers for the use of assets, expressed as a percentage of the principal.

Coupon Bond

A bond that entitles the holder to receive periodic interest payments (coupons) and the principal back at maturity.

Effective Yield

Effective yield is the total yield on an investment, taking into account the effects of compounding interest or reinvestment over a given period.

Q9: Werger Manufacturing Corporation has a traditional costing

Q17: Ulrich Company has a Castings Division which

Q20: Stibbins Products, Inc., has a Receiver Division

Q21: The management of Wrights Corporation would like

Q22: Bernosky Corporation is conducting a time-driven activity-based

Q29: Chruch Corporation manufactures numerous products, one of

Q32: Two of the decentralized divisions of Gamberi

Q45: Letcher Corporation manufactures and sells one product.

Q63: Chojnowski Incorporated makes a single product-a cooling

Q93: Decelle Corporation is considering a capital budgeting