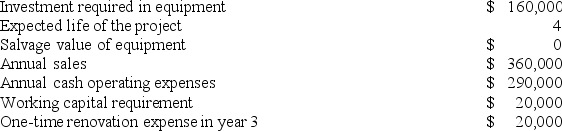

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

Definitions:

Pay Bills

The process of settling amounts owed for purchases, services, or utilities to vendors or suppliers.

Reports Center

A centralized location or platform where various types of business reports can be accessed, generated, or managed.

Vendors Center

A feature in accounting software that organizes and tracks transactions related to suppliers from whom a business purchases goods or services.

Reports Menu

A feature within software or an accounting system that provides access to a variety of financial and operational reports.

Q11: Nance Corporation is about to introduce a

Q20: A capital budgeting project's incremental net income

Q31: Hiss Corporation's activity for the last six

Q36: Rainbolt Incorporated makes a single product-an electrical

Q63: Ohanlon Corporation manufactures numerous products, one of

Q82: The management of Landstrom Corporation would like

Q93: The manufacturing overhead variance that is a

Q107: Morine Corporation is conducting a time-driven activity-based

Q126: Eastwood Corporation manufactures numerous products, one of

Q138: Chruch Corporation manufactures numerous products, one of