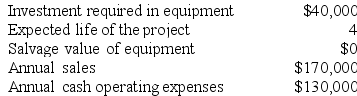

Morefield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Takeover Attempt

A bid by a company or investor to acquire control of another company, often by purchasing a substantial portion of its stock.

White Knight

A friendly investor or company that acquires a firm at risk of a hostile takeover, often viewed as a more favorable option by the target company's management.

Bonds

Fixed-income securities that represent a loan made by an investor to a borrower, typically corporate or governmental, which includes terms for variable or fixed interest payments and the return of the original investment at maturity.

Shares

Units of ownership interest in a corporation or financial asset, providing an equal distribution in any profits, if any are declared, in the form of dividends.

Q9: Wollan Corporation has two operating divisions--an East

Q21: If the lowest acceptable transfer price from

Q38: Buckbee Corporation manufactures and sells one product.

Q40: If the formula for the markup percentage

Q40: Managers can use a variety of methods

Q66: Mccluer Corporation is conducting a time-driven activity-based

Q75: Lemaire Corporation is conducting a time-driven activity-based

Q137: Demand for a product is said to

Q159: Emanuele Incorporated makes a single product--a critical

Q224: Bolka Corporation, a merchandising company, reported the