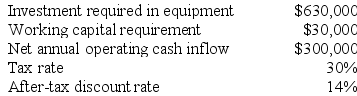

Ariel Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Bad Debt Expense

The cost associated with accounts receivable that a company is not able to collect from its debtors, recognized as an expense on the income statement.

Net Realizable Value

The estimated selling price of goods, minus the estimated costs of completion and the costs necessary to make the sale, often used in inventory valuation and accounts receivable.

Notes Receivable

Financial claims against debtors documented through promissory notes that promise to pay the amount due with interest.

Bad Debt Expense

An expense account reflecting the cost of accounts receivable that a company does not expect to collect.

Q6: Jahnel Corporation is conducting a time-driven activity-based

Q6: Alapai Corporation has a standard cost system

Q12: Division P of the Nyers Company makes

Q29: Iacob Corporation is a wholesaler that sells

Q34: Salem Corporation is conducting a time-driven activity-based

Q56: Secore Robotics Corporation has developed a new

Q79: Utility costs at one of Hannemann Corporation's

Q91: Tantanka Manufacturing Corporation uses a standard cost

Q112: Nance Corporation is about to introduce a

Q148: Acri Corporation manufactures numerous products, one of