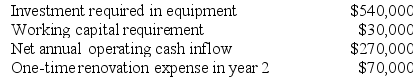

Skowyra Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $180,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30%. The after-tax discount rate is 7%. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $180,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30%. The after-tax discount rate is 7%. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Representative Sample

A portion of a population that reliably mirrors the attributes of the entire group.

Dependent Variable

The variable being tested and measured in a scientific experiment, which is affected by the manipulation of the independent variable.

Interviewed

The process of being asked questions by someone seeking to gather information or assess qualifications, typically in a formal setting.

Residents

Individuals living in a specified area or belonging to a specific community, often used to describe people living in a particular city or town.

Q11: A manufacturing company has a standard costing

Q33: The management of Plitt Corporation would like

Q49: Cieslinski Corporation is conducting a time-driven activity-based

Q68: Ledonne Corporation is conducting a time-driven activity-based

Q74: Ebbs Products, Inc., has a Motor Division

Q94: Bartucci Corporation is conducting a time-driven activity-based

Q111: Bedolla Corporation is considering a capital budgeting

Q136: Tantanka Manufacturing Corporation uses a standard cost

Q155: Fenderson Incorporated makes a single product--a cooling

Q172: The following data for May has been