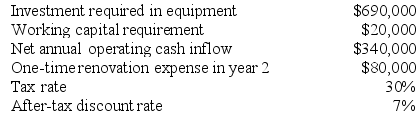

Patenaude Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Kinesthesia

The sense that detects body position, weight, or movement of the muscles, tendons, and joints.

Embodied Cognition

The influence of bodily sensations, gestures, and other states on cognitive preferences and judgments.

Sensory Interaction

The principle that one sensory modality may influence or interact with another, enhancing or diminishing the perception of stimuli.

McGurk Effect

An auditory illusion demonstrating the interaction between hearing and vision in speech perception, where what is seen overrides what is heard.

Q6: The management of Casablanca Manufacturing Corporation believes

Q6: Dunnings Woodworking Corporation produces fine cabinets. The

Q10: Ralph Plastics Equipment Corporation has developed a

Q20: The absorption costing approach to cost-plus pricing

Q24: Raycroft Corporation is conducting a time-driven activity-based

Q34: Reye Corporation has provided the following information

Q39: Souffront Corporation manufactures and sells one product.

Q43: Yashinski Corporation manufactures numerous products, one of

Q68: Bourland Corporation is considering a capital budgeting

Q118: Inscho Corporation manufactures numerous products, one of