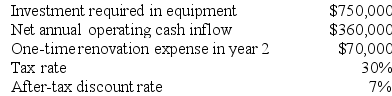

Sester Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Amortized Historical Cost

The accounting method of gradually writing off the initial cost of an asset over a period, adjusting for depreciation or amortization.

Market Value

The present listed price for purchasing or selling an asset or service in a market.

Fair Value Hedge

A specific hedging strategy used to mitigate the risk of changes in the fair value of an asset or liability or an unrecognized firm commitment.

Hedge Accounting

An accounting method that records the offsetting positions of a financial hedge and its underlying asset together to reduce volatility in financial statements.

Q3: Coudriet Manufacturing Corporation has a traditional costing

Q10: Ralph Plastics Equipment Corporation has developed a

Q27: The management of Plitt Corporation would like

Q29: Oaks Company maintains a cafeteria for its

Q35: Mausser Woodworking Corporation produces fine cabinets. The

Q67: Koppenhaver Products, Inc., has a Relay Division

Q74: Standard Corporation has developed standard manufacturing overhead

Q94: Marbry Corporation has provided the following information

Q102: Oberley Products, Inc., has a Receiver Division

Q141: Target costing involves adding a target profit