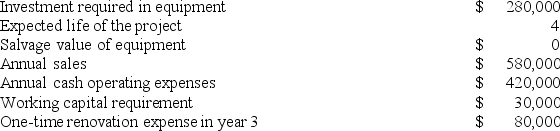

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the entire project is closest to:

Definitions:

Foreign Trade

The exchange of goods, services, and capital between countries and territories, influencing the global economy.

GDP

Gross Domestic Product, the total market value of all final goods and services produced within a country in a given period.

Trade Adjustment Assistance

A federal program offering aid to workers who lose their jobs or whose hours and wages are reduced due to the impact of international trade.

Subsidies

Financial support provided by the government to businesses, individuals, or other governmental bodies, intended to encourage production, reduce prices, or support activities deemed beneficial.

Q7: Grandin Corporation manufactures and sells one product.

Q8: Nafth Company has an Equipment Services Department

Q32: Decelle Corporation is considering a capital budgeting

Q36: Morice Industries Inc. has developed a new

Q47: When a company invests in equipment, it

Q72: Schwiesow Corporation has provided the following information:

Q93: The manufacturing overhead variance that is a

Q102: Prudencio Corporation has provided the following information

Q123: Diehl Corporation uses a standard cost system

Q139: An outdoor barbecue grill manufacturer uses a