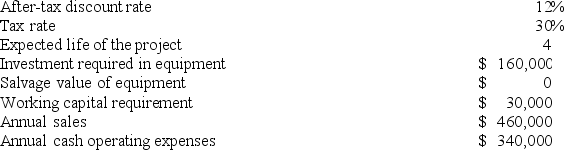

Waltermire Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Q16: For performance evaluation purposes, the fixed costs

Q33: Wangerin Corporation applies overhead to products based

Q34: The markup over cost under the absorption

Q42: Paletta Corporation has provided the following information

Q48: Krueger Corporation is conducting a time-driven activity-based

Q55: Cieslinski Corporation is conducting a time-driven activity-based

Q107: Ludy Mechanical Corporation has developed a new

Q121: A manufacturer of playground equipment has a

Q132: A partial listing of costs incurred at

Q134: A manufacturing company has a standard costing