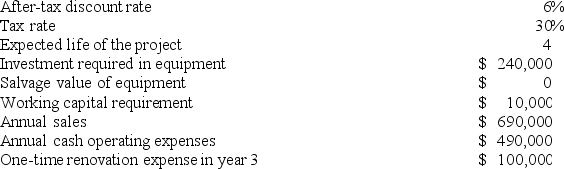

Lafromboise Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

Definitions:

Fixed Assets

Long-term tangible assets held for business use and not expected to be converted to cash in the upcoming fiscal year, such as machinery, buildings, and land.

Full Capacity

The maximum level of output that a company can sustain over a long period without increasing its resources.

Sales Level

The total volume or value of all products or services sold by a company within a specific period.

Fixed Assets

Long-term tangible assets used in the operation of a business that are not expected to be converted to cash within a year.

Q43: Yashinski Corporation manufactures numerous products, one of

Q73: Shilt Corporation is considering a capital budgeting

Q82: Jessep Corporation has a standard cost system

Q86: Code Corporation is conducting a time-driven activity-based

Q97: Tavis Robotics Corporation has developed a new

Q101: An unfavorable volume variance means that the

Q114: Wermers Industries Inc. has developed a new

Q127: Boersma Sales, Inc., a merchandising company, reported

Q132: The fixed manufacturing overhead budget variance equals:<br>A)

Q134: Prudencio Corporation has provided the following information