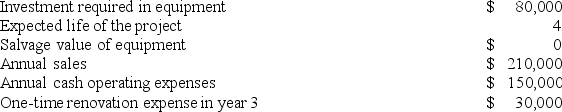

Planas Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Endometritis

The inflammation of the inner lining of the uterus, often caused by infection.

Iatrogenic

Refers to conditions or symptoms that occur as a result of medical treatment or interventions.

Ovarian Disorder

A condition affecting the ovaries, which can interfere with fertility, hormonal balance, or the menstrual cycle.

Saline Infusion Sonohysterography

A diagnostic procedure that uses ultrasound and saline solution to visualize the uterus and endometrial cavity.

Q18: Leheny Corporation manufactures and sells one product.

Q18: Schlaefer Corporation is conducting a time-driven activity-based

Q27: Weimar Corporation is conducting a time-driven activity-based

Q40: Stopyra Incorporated makes a single product-a cooling

Q63: Management of Plascencia Corporation is considering whether

Q64: Boggess Corporation manufactures numerous products, one of

Q74: Coache Corporation is considering a capital budgeting

Q125: Fleming Incorporated makes a single product-a critical

Q129: Whittenton Corporation manufactures numerous products, one of

Q136: Annala Corporation is considering a capital budgeting