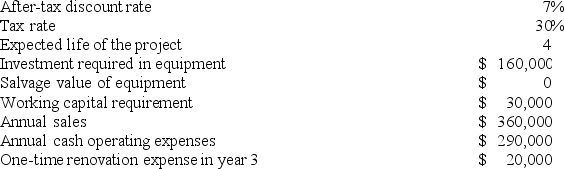

Houze Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

Definitions:

Acceptance

In contract law, the agreement by the party receiving an offer to the terms of that offer, leading to a binding contract.

Contract

A legally binding agreement between two or more parties that outlines obligations they must fulfill.

Without Reserve

In auctions, this refers to items being sold with no minimum bidding threshold, indicating they will be sold to the highest bidder regardless of the price.

Auction

An auction is a sale where items are offered for purchase to the individual who presents the highest offer.

Q2: Bullie Manufacturing Corporation has a traditional

Q7: Perwin Corporation estimates that an investment of

Q8: Doell Corporation is conducting a time-driven activity-based

Q38: Hollifield Corporation is conducting a time-driven activity-based

Q41: Labadie Corporation manufactures and sells one product.

Q58: Liapis Products, Inc., has a Valve Division

Q61: Ahart Products, Inc., has a Transmitter Division

Q75: Tavis Robotics Corporation has developed a new

Q143: A product's economic value to the customer

Q161: A fixed manufacturing overhead budget variance occurs