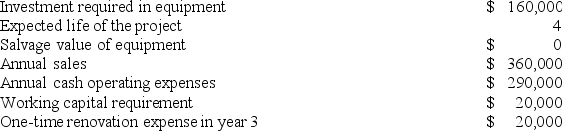

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Demand Curve

A graph that illustrates the relationship between the price of a good or service and the quantity demanded by consumers at various prices, typically sloping downward from left to right.

Cost Functions

Mathematical relationships that express how a firm’s costs depend on the quantity of output it produces.

Economic Profits

The surplus or profits generated by a firm after accounting for both explicit and implicit costs.

Fixed Cost

Expenses that do not change with the level of output produced, such as rent or salaries.

Q11: Leheny Corporation manufactures and sells one product.

Q41: Held Incorporated makes a single product--an electrical

Q49: Gamach Corporation is a wholesaler that sells

Q60: Roediger Corporation is conducting a time-driven activity-based

Q65: Flick Company uses a standard cost system

Q95: Siegrist Products, Inc., has a Pump Division

Q102: Deninno Corporation is conducting a time-driven activity-based

Q130: Spach Corporation manufactures numerous products, one of

Q134: A manufacturing company has a standard costing

Q146: Muscato Corporation estimates that its variable manufacturing