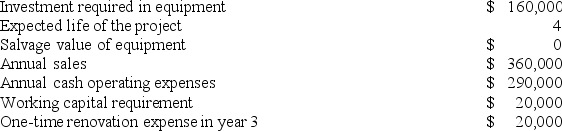

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

Definitions:

System

A set of interconnected elements or components that are organized for a particular purpose or function.

School Development Program

Initiatives or plans implemented to improve the quality of education and enhance the overall school environment for students.

Policy Makers

Individuals or groups involved in the process of creating policies, laws, or regulations at various levels of government or organizations.

Epstein's Family Involvement

The model that emphasizes the role of various family engagement strategies in children's education, developed by Joyce Epstein.

Q6: Njombe Corporation manufactures a variety of products.

Q13: Nurre Corporation manufactures and sells one product.

Q29: Furtado Incorporated makes a single product-a cooling

Q29: Vandermeer Products, Inc., has a Antennae Division

Q30: Leshem Incorporated makes a single product-an electrical

Q34: Least-squares regression selects the values for the

Q48: Stokan Products, Inc., has a Antennae Division

Q70: Jorgenson Corporation has provided the following data

Q75: Lemaire Corporation is conducting a time-driven activity-based

Q119: Correll Corporation is considering a capital budgeting