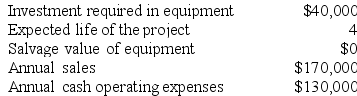

Morefield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.

The company uses straight-line depreciation. The depreciation expense will be $10,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Ethical Dilemma

A situation in which a person is required to choose between two conflicting moral principles, making it difficult to decide what is right.

Quandary Ethics

Quandary ethics deals with situations where moral obligations conflict or where it's difficult to determine the right course of action, leading to ethical dilemmas or quandaries.

Character Ethics

A branch of ethics focused on virtues and moral character as the foundation of ethical behavior, rather than rules or consequences.

Happiness Concern

The issue or focus on understanding what factors contribute to human happiness and well-being.

Q6: Dallavalle Corporation manufactures and sells one product.

Q15: Mannerman Products, Inc., operates an electric power

Q18: Fabert Incorporated makes a single product--a cooling

Q26: Labadie Corporation manufactures and sells one product.

Q29: Callum Corporation is conducting a time-driven activity-based

Q41: Herrell Corporation manufactures numerous products, one of

Q52: Stapel Corporation is conducting a time-driven activity-based

Q63: Management of Plascencia Corporation is considering whether

Q109: Lennox Corporation has provided the following information

Q116: Maertz Corporation applies manufacturing overhead to products