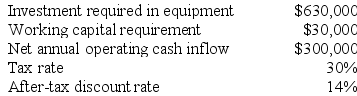

Ariel Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Performing Duties

The act of carrying out responsibilities or tasks that are part of one's job or role.

Partial Deliveries

In commercial transactions, the act of delivering a portion of goods distinct from the total quantity stipulated in a contract, often subject to agreement by the involved parties.

Late Delivery

The act of failing to deliver goods or complete a service by the agreed-upon or expected time.

Cancel the Contract

The act of formally terminating a contractual agreement, either through mutual consent of the parties involved or due to the breach of contract terms by one party.

Q5: For performance evaluation purposes, the actual fixed

Q5: A manufacturing company has a standard costing

Q11: Pacius Corporation is conducting a time-driven activity-based

Q33: Under the simplifying assumptions made in the

Q36: Rainbolt Incorporated makes a single product-an electrical

Q53: The Blaine Corporation is a highly automated

Q59: Fontana Corporation is considering a capital budgeting

Q71: Hara Corporation is a wholesaler that sells

Q122: Dori Castings is a job order shop

Q136: Jaakola Corporation makes a product with the