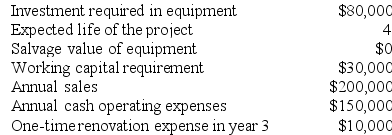

Galati Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $20,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 8%.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $20,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 8%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Intangible Benefit

A non-quantifiable advantage or positive outcome derived from a product or service, such as brand recognition or customer loyalty.

Discount Rate

This is the discount rate used to figure out what future cash flows are worth in the present in discounted cash flow analysis.

Small Used Aircraft

A previously owned aircraft that is smaller in size, often used for personal, business, or small commercial purposes.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Q1: When the fixed costs of capacity are

Q7: There can be no volume variance for

Q14: You have deposited $24,764 in a special

Q28: Buckbee Corporation manufactures and sells one product.

Q28: Garrell Corporation is conducting a time-driven activity-based

Q40: Risser Woodworking Corporation produces fine cabinets. The

Q55: Seamons Corporation has the following information available

Q60: Chojnowski Incorporated makes a single product-a cooling

Q63: Babuca Corporation has provided the following production

Q114: Jessep Corporation has a standard cost system