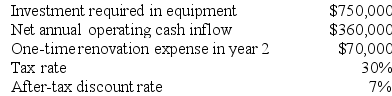

Sester Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Long-term Prepayment

Payments made in advance for goods or services to be received or used in future periods, extending beyond the current accounting year.

Accounting Transaction

A financial event that changes the balance of two or more accounts in the ledger.

Accounting Time Period

A specific duration of time for which financial statements are prepared, typically a quarter or a year.

Depreciation Expense

A rephrased definition: The charge to income, representing the allocation of the cost of an asset over its useful life during a specific period.

Q5: For performance evaluation purposes, the actual fixed

Q24: The cost of labor time required to

Q33: Setting transfer prices at full cost can

Q36: Which of the following companies is following

Q41: The least-squares regression method computes the regression

Q50: Electrical costs at one of Rome Corporation's

Q96: Arca Incorporated makes a single product-a critical

Q100: In net present value analysis, an investment

Q109: Lennox Corporation has provided the following information

Q141: Garrity Corporation bases its predetermined overhead rate