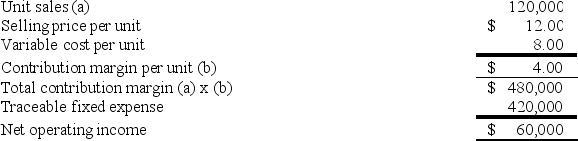

Starowicz Corporation manufactures numerous products, one of which is called Beta10. The company has provided the following data about this product:  Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

Management is considering decreasing the price of Beta10 by 7%, from $12.00 to $11.16. The company's marketing managers estimate that this price reduction would increase unit sales by 15%, from 120,000 units to 138,000 units. Assuming that the total traceable fixed expense does not change, what net operating income will product Beta-10 earn at a price of $11.16 if this sales forecast is correct?

Definitions:

Blue Chip Stocks

Shares in large, reputable companies known for their ability to operate profitably in good and bad times.

Stock Splits

A corporate action that increases the number of a company's outstanding shares by dividing each share, which in turn reduces the price of each share, aiming to make shares more affordable.

Marginal Tax Bracket

The tax rate that applies to the last dollar of the taxpayer's income, indicating how much tax will be paid on any additional income earned.

Municipal Bond

A debt security issued by a state, municipality, or county to finance its capital expenditures, usually exempt from federal taxes and, in some cases, state and local taxes.

Q1: Which of the following would be classified

Q3: Weitman Corporation manufactures numerous products, one of

Q4: Hartnett Company's quality cost report is to

Q4: One of Matthew Corporation's competitors has learned

Q10: Arca Incorporated makes a single product-a critical

Q19: Lakeside Nursing Home has two operating departments,

Q30: Ghia Manufacturing Corporation charges its Maintenance Department's

Q32: Cannata Corporation has two operating divisions--a North

Q35: Schweinsberg Corporation is considering a capital budgeting

Q145: Podratz Corporation has provided the following information