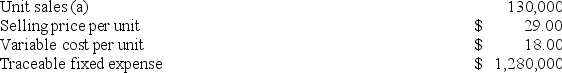

Weitman Corporation manufactures numerous products, one of which is called Epsilon-50. The company has provided the following data about this product:  Assume that the total traceable fixed expense does not change. How many units of product Epsilon-50 would Weitman need to sell at a price of $31.61 to earn the same net operating income that it currently earns at a price of $29.00? (Round your answer up to the nearest whole number.)

Assume that the total traceable fixed expense does not change. How many units of product Epsilon-50 would Weitman need to sell at a price of $31.61 to earn the same net operating income that it currently earns at a price of $29.00? (Round your answer up to the nearest whole number.)

Definitions:

Per-Unit Tax

A tax that is levied on a product based on a fixed amount per unit, affecting the supply curve by elevating production costs.

Tax Burden

The measure of the total amount of taxes imposed by a government on individuals, businesses, and other entities, often expressed as a percentage of GDP.

Product Structure

An organizational framework that groups together all the elements involved in producing a specific product or product line.

Organizational Structures

The framework within which organizational tasks are divided, resources are allocated, and departments are coordinated.

Q5: Woodall Corporation manufactures and sells one product.

Q5: At an interest rate of 14%, approximately

Q13: Wrench Corporation is conducting a time-driven activity-based

Q19: The management of Schneiter Corporation would like

Q23: Fabrick Company's quality cost report is to

Q59: One of Matthew Corporation's competitors has learned

Q63: Ganus Products, Inc., has a Relay Division

Q66: Blauvelt Electronics Corporation has developed a new

Q93: The manufacturing overhead variance that is a

Q101: An unfavorable volume variance means that the