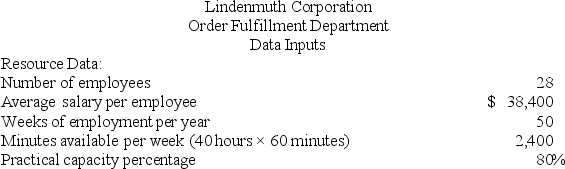

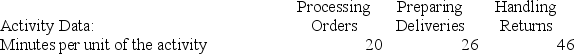

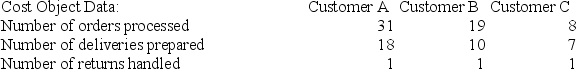

Lindenmuth Corporation is conducting a time-driven activity-based costing study in its Order Fulfillment Department. The company has provided the following data to aid in that study:

On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer C would be closest to:

On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer C would be closest to:

Definitions:

Direct Method

A cash flow statement preparation approach that itemizes actual cash inflows and outflows from operating activities, as opposed to estimating them through indirect adjustments.

Expenses and Losses

Costs incurred in the operation of a business (expenses) and decreases in value not directly related to operations (losses).

Depreciation

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life, reflecting its consumption, wear and tear, or obsolescence.

Direct Method

A cash flow statement approach that lists major classes of gross cash receipts and payments.

Q11: Traeger Woodworking Corporation produces fine cabinets. The

Q13: The R<sup>2</sup> (i.e., R-squared) varies from 0%

Q19: A manufacturing company has a standard costing

Q29: Iacob Corporation is a wholesaler that sells

Q34: Least-squares regression selects the values for the

Q35: Wilson Corporation's activity for the first six

Q47: When a company invests in equipment, it

Q99: According to the text,most adolescents become interested

Q141: Garrity Corporation bases its predetermined overhead rate

Q160: Dr.Justice is arguing against the 2015 trend