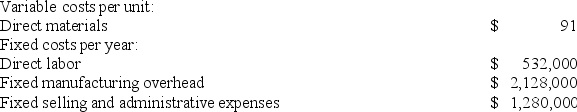

Stubenrauch Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 38,000 units and sold 32,000 units. The company's only product is sold for $240 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 38,000 units and sold 32,000 units. The company's only product is sold for $240 per unit.

Assume that the company uses a variable costing system that assigns $14 of direct labor cost to each unit that is produced. The net operating income under this costing system is:

Definitions:

Materials Handling

Activities involved in moving, storing, controlling, and protecting materials and products throughout the manufacturing, warehousing, distribution, consumption, and disposal processes.

Allocation Rate

A financial metric used to assign indirect costs to different projects or departments within an organization.

Total Overhead

The total of all indirect costs associated with the manufacturing process, including indirect labor, materials, and other expenses necessary for production.

Overhead Allocation

The process of distributing overhead costs to produced goods based on a predetermined method, often reflecting the usage of resources in production.

Q4: Guillaume Corporation manufactures and sells one product.

Q23: Babuca Corporation has provided the following production

Q26: Labadie Corporation manufactures and sells one product.

Q28: Fudo has been getting into trouble with

Q40: Eaglin Company's quality cost report is to

Q47: Paparelli Corporation manufactures and sells one product.

Q99: According to the text,most adolescents become interested

Q119: Fleisher Corporation is conducting a time-driven activity-based

Q134: Alway Candy Corporation is implementing a target

Q173: When people enter formal operations,they can do