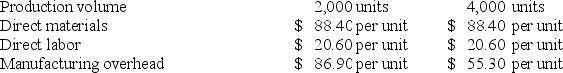

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:  The best estimate of the total cost to manufacture 2,200 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 2,200 units is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Average Tax Rate

A metric that reflects the ratio of total taxes paid to total income, showing the proportion of income that goes towards tax payments.

Tax Liability

The total amount of tax owed to a taxing authority by an individual, organization, or other entity.

Income

Consistent financial returns from professional activities or investments.

Average Tax Rate

The percentage of total income that is paid in taxes, indicating the proportion of an individual's income that is allocated towards taxes.

Q15: Marcelin Corporation manufactures and sells one product.

Q30: Coble Woodworking Corporation produces fine cabinets. The

Q54: Choi Corporation is conducting a time-driven activity-based

Q56: The accounting department of Archer Company,

Q82: The management of Landstrom Corporation would like

Q85: Callum Corporation is conducting a time-driven activity-based

Q88: Morice Industries Inc. has developed a new

Q102: The _ refers to the fact that

Q122: Lamorte Corporation is conducting a time-driven activity-based

Q134: Parents can expect a more harmonious relationship