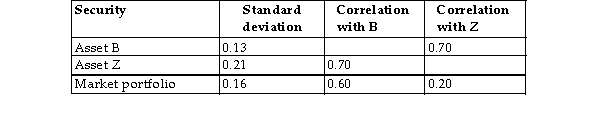

The following table provides standard deviations and correlation coefficients relating to two risky securities,B and Z,and the market portfolio.Use this information to estimate the beta and expected returns on securities B and Z,assuming an expected return on the market portfolio of 12%,and a risk- free return of 5.5%.

Definitions:

Consistency

In accounting, the principle that mandates the use of the same accounting methods and practices over time for financial reporting.

Qualitative Characteristics

Aspects that contribute to the usefulness of financial information, including its relevance and reliability.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity, presenting the financial performance and position at a given period.

Q4: The growth rate must be greater than

Q6: Jeremy's Sports Equipment is considering sponsoring a

Q6: On 30 December 2009 MXM Group releases

Q29: The ASX is an example of which

Q38: Techniques that involve hedging,purchasing insurance,or changing gearing

Q40: Woodfull Corporation bought an empty warehouse building

Q43: Under the imputation tax system,what will be

Q110: The developmental science term for environmental forces

Q140: Sara is describing some effects of the

Q221: What question would a person ask to