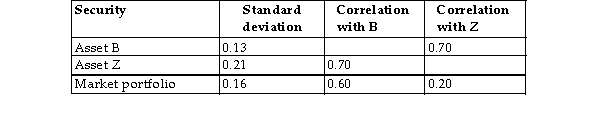

The following table provides standard deviations and correlation coefficients relating to two risky securities,B and Z,and the market portfolio.Use this information to estimate the beta and expected returns on securities B and Z,assuming an expected return on the market portfolio of 12%,and a risk- free return of 5.5%.

Definitions:

Institute Of Medicine

An independent, nonprofit organization working outside of government to provide unbiased and authoritative advice to decision makers and the public on health and medical issues.

State Board Of Nursing

A regulatory agency in each state responsible for the licensure and discipline of nurses, ensuring the practice of nursing meets the established standards for safety and competency.

Social Policy Statement

An official outline of principles and interventions aimed at addressing societal issues and promoting welfare.

American Nurses' Association

A professional organization representing the interests of the nation's registered nurses, providing a framework for nursing standards and policies.

Q1: The NPV technique is the only investment

Q3: Which of the following constitutes agency trading?<br>A)A

Q9: Investors must choose between stocks that are

Q9: The future value of an ordinary annuity

Q13: Dividend policy refers only to the choice

Q14: The minimum variance portfolios are _.<br>A)A subset

Q15: DVD Entertainment Group Ltd has net borrowings

Q40: Which of the following is not a

Q46: The constant dividend growth model is superior

Q220: Which person is conducting a qualitative study