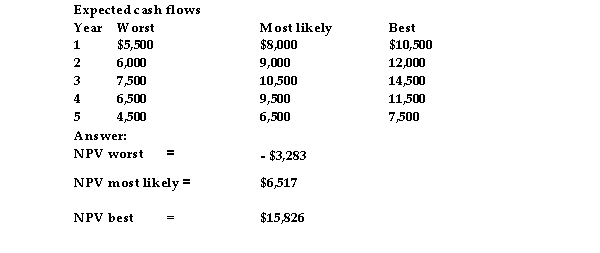

O'Reilly Ltd is considering purchasing a spinning machine which will cost $25,000.It has a five- year life and will be worthless after that.O'Reilly's cost of capital is 12%.Because of uncertainty in the economic situation the after- tax cash inflows for each of the five years are uncertain.The company has estimated expected cash flows,as shown below,for three possible economic results: worst case,most likely case and best case.Calculate the NPVs for each of the possible economic results.Is this project very risky?  Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Definitions:

Defense Line Buffer

A term in nursing referring to mechanisms or strategies that protect individuals from health stressors or help in maintaining stability during health challenges.

Flexible Line

A concept or tool that can be adapted or adjusted to meet various needs or purposes, often used in creative or strategic thinking.

Stressor Defense Line

Theoretical lines of defense that individuals or systems employ to protect against stressors and maintain stability.

Adaptation Model

A framework that suggests individuals strive to maintain balance in their environment by adjusting to changes and stressors.

Q4: The beta of a stock A is

Q5: Prices follow a 'random walk' if the

Q17: Because equity cash flows are generally unstable

Q20: The Miller- Orr model minimises the opportunity

Q28: Under Modigiliani and Miller's dividend irrelevance theory,the

Q36: What is the total value of all

Q37: In general,individual stock returns appear to be

Q48: The existence of dividend clientele suggests dividend

Q92: Normative life events are the same in

Q195: In a(n)_,the researcher assigns groups to different