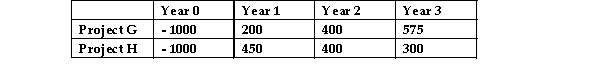

ABC Ltd and DEF Ltd are each considering the same two investment projects;Project G and Project H.These two projects are mutually exclusive.The cash flows produced by each project are the same for both companies.These cash flows are given below:  The required rate of return of ABC Ltd is 6.3% whilst the required rate of return of DEF ltd is 4.1% pa.The IRR is Project G is 7.27% whilst the IRR of Project H is 7.87%.Which project should each company invest in if they wish to maximise shareholder wealth?

The required rate of return of ABC Ltd is 6.3% whilst the required rate of return of DEF ltd is 4.1% pa.The IRR is Project G is 7.27% whilst the IRR of Project H is 7.87%.Which project should each company invest in if they wish to maximise shareholder wealth?

Definitions:

Sterile Water

Water that has been purified and treated to remove all microbes and contaminants, used in medical and laboratory settings to ensure safety.

Charting By Exception (CBE)

A documentation strategy in nursing where only significant findings or deviations from norms are recorded.

Narrative Format

A method of writing or presenting information in the form of a story or account of events.

Patient Care

The services rendered by healthcare professionals to individuals seeking to improve or maintain their health status.

Q4: The extent to which the return of

Q22: A deferred annuity is an annuity due

Q32: When estimating the cost of equity,which of

Q32: Capricorn Industries Ltd is considering three mutually

Q36: In order for a company to seek

Q46: It is not possible to eliminate all

Q52: An ordinary annuity has unequal cash flows.

Q76: Dr.Patel is a behavioral geneticist.He would be

Q121: What is the chapter's take away message

Q164: Freud referred to the mass of instincts