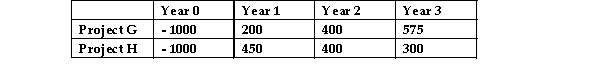

ABC Ltd and DEF Ltd are each considering the same two investment projects;Project G and Project H.These two projects are mutually exclusive.The cash flows produced by each project are the same for both companies.These cash flows are given below:  The required rate of return of ABC Ltd is 6.3% whilst the required rate of return of DEF ltd is 4.1% pa.The IRR is Project G is 7.27% whilst the IRR of Project H is 7.87%.Which project should each company invest in if they wish to maximise shareholder wealth?

The required rate of return of ABC Ltd is 6.3% whilst the required rate of return of DEF ltd is 4.1% pa.The IRR is Project G is 7.27% whilst the IRR of Project H is 7.87%.Which project should each company invest in if they wish to maximise shareholder wealth?

Definitions:

Adaptation

The process by which organisms adjust and change to their environment for survival and reproduction.

Stimulus Habit

The development of a repeated, automatic response to a specific stimulus over time.

Attention

The act of concentrating on a specific object, task, or activity while ignoring irrelevant information or distractions.

Intensity

The degree of strength, force, or concentration of an activity, emotion, or property.

Q3: An initial public offering in which the

Q6: Investors have different attitudes towards risk.

Q10: A shareholder whose marginal tax rate is

Q21: A share that trades with rights to

Q23: The shareholders of DEF Systems Ltd have

Q26: The idea that the set of investors

Q26: Which of the following is not a

Q26: A market order is one that specifies

Q46: It is not possible to eliminate all

Q52: What are the three main decisions corporate