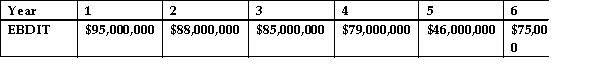

taxis Industries is considering a project that would involve the purchase and refitting of a new manufacturing facility.The following information is known about this project:  The initial cost of the purchase and refit of the facility is $300,000,000.There is expected to be no salvage value.

The initial cost of the purchase and refit of the facility is $300,000,000.There is expected to be no salvage value.

The facility can be depreciated using straight- line depreciation over a four- year life The current tax rate is 36%

A)What is the average accounting rate of return on the project?

B)Based upon this result should Tavis Industries accept this project?

Definitions:

Low-Grade Fever

A mild elevation in body temperature above the normal range, often indicative of an underlying infection or inflammation.

Surgical Unit

A specialized hospital department where surgical operations are carried out.

Framingham Study

A long-term, ongoing cardiovascular cohort study on residents of Framingham, Massachusetts, which has contributed significantly to knowledge about heart disease.

Commonly Accepted Practice

A method or procedure that is widely regarded as standard or conventional in a particular field or industry.

Q2: Firms that borrow excessively face which one

Q5: Which of the following is false?<br>A)A large

Q9: Which of the following pieces of information

Q15: Which of the following best describes a

Q18: The beta of a stock A is

Q27: A weak negative relationship between the return

Q33: What are the choices that corporate managers

Q38: Which of the following pieces of information

Q41: What is the future value of $500

Q42: Under the imputation tax system,what will be