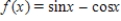

Use a graphing utility to graph the function.

Definitions:

Call Contract

A financial contract that gives the holder the right, but not the obligation, to buy a specified amount of an underlying asset at a predetermined price within a specified time period.

Put Contract

A financial agreement that grants the holder permission, but not the requirement, to sell a certain amount of an underlying asset at a predetermined price before a certain deadline.

Call Premium

The additional cost over the par value that an investor must pay to purchase a callable security before its maturity date.

Strike Price

The predetermined price at which the holder of an option can buy (call) or sell (put) the underlying asset, until the option expires.

Q28: Given a = 8, b = 14,

Q56: Use the trigonometric substitution to rewrite the

Q79: Solve the multiple-angle equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7896/.jpg"

Q131: Using the grid provided, sketch the graph

Q136: Find the trigonometric form of <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7896/.jpg"

Q147: Evaluate the following expression. <br>4 tan x

Q232: Use DeMoivre's Theorem to find the indicated

Q234: Find the value of given trigonometric function.Round

Q238: Use the sum-to-product formulas to rewrite the

Q333: Evaluate the expression.Round your result to two