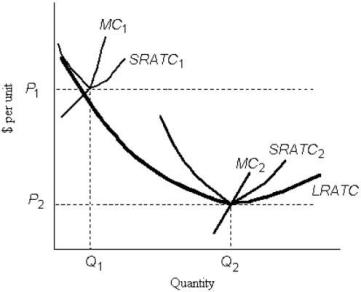

Consider the following cost curves for Firm X,a perfectly competitive firm.

FIGURE 9- 5

FIGURE 9- 5

-Refer to Figure 9- 5.If Firm X has a capital stock that generates SRATC1,then in the long run Firm X will have to

Definitions:

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period, used in capital budgeting to assess the profitability of an investment.

Working Capital

An indicator of a company's short-term financial health and operational efficiency, calculated as current assets minus current liabilities.

Discount Rate

The interest rate used in discounted cash flow analysis to determine the present value of future cash flows or to evaluate the attractiveness of an investment.

Net Present Value

A valuation method that calculates the present value of an investment's expected cash flows, minus the initial investment cost.

Q8: Refer to Figure 34- 2.Suppose Canada has

Q36: Real capital includes<br>A)owner's equity.<br>B)a firm's balance in

Q48: Which of the following is most likely

Q58: Refer to Table 7- 1.The explicit costs

Q82: Solve the following equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7896/.jpg"

Q97: An example of debt financing for any

Q98: Refer to Figure 34- 2.If Canada were

Q113: Refer to Figure 8- 5.If the cost-

Q267: Select the graph of the function and

Q527: Use a graphing utility to approximate the