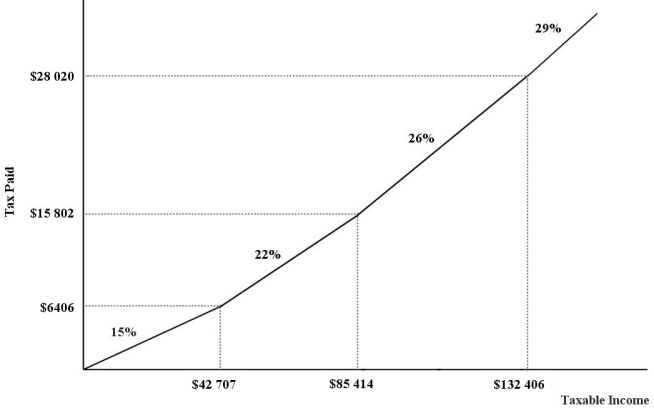

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.What must be true of the four marginal income- tax rates in order for the tax to be considered a "flat" tax?

Definitions:

Rescission

The legal action of cancelling, terminating, or annulling a contract, restoring the parties to their original positions prior to the agreement.

Surety

A person or entity that takes responsibility for another's performance of an undertaking, such as fulfilling the terms of a contract.

Fraud

A deliberate deception practiced to secure unfair or unlawful gain.

Article 9

A provision under the Uniform Commercial Code (UCC) dealing with secured transactions in personal property, where a creditor has a security interest in the debtor's property.

Q1: Consider the trade of a product between

Q2: Refer to Figure 34- 2.Suppose Canada has

Q3: Refer to Figure 34- 4.Suppose the world

Q13: If the income effect of a price

Q16: The government has seatbelt and airbag requirements

Q22: Refer to Figure 16- 3.Assume there are

Q31: Refer to Figure 6- 9.In part (i),the

Q66: Which of the following best describes the

Q87: A good example of a product that

Q89: Consider an industry producing good X.The quantity