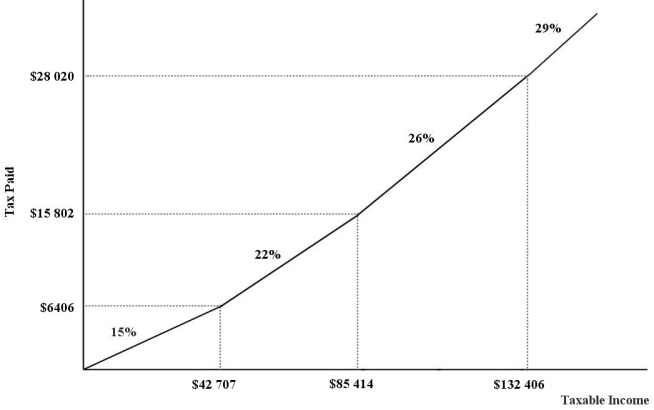

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.An individual with a taxable income of $39 500 will pay in income taxes.

Definitions:

Salaries Payable

A liability account that records the amount of salaries owed to employees but not yet paid.

Accrued

Income earned or expenses incurred before cash has been exchanged, often recognized in the accounting process.

Insurance Policy

A legal contract between an insurer and the insured, outlining the terms, coverages, premiums, and conditions under which the insurer agrees to compensate the insured.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate revenues and expenses to the period in which they actually occurred.

Q5: Suppose that many coal mines are shut

Q7: The main point about public choice theory

Q22: Which of the following methods of import

Q24: In recent decades the economy has experienced

Q29: Suppose a consumer can purchase only two

Q53: The paradox in "the paradox of value"

Q55: Refer to Figure 17- 4.Ignore the horizontal

Q57: Suppose there is only one movie theatre

Q59: Taking all federal and provincial expenditures into

Q73: Suppose economists at the World Bank discover