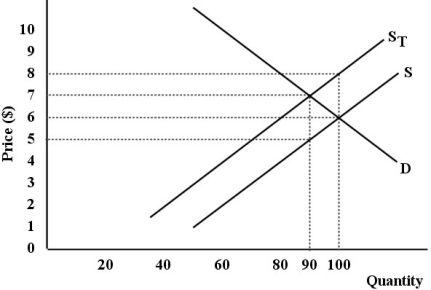

The diagram below shows supply and demand diagrams (S and D) for some product.The government then imposes an excise tax.The new supply curve is ST.

FIGURE 18- 4

FIGURE 18- 4

-Refer to Figure 18- 4.What is the dollar value of the excess burden of this tax?

Definitions:

Finance Lease Agreement

A lease in which the lessee has control over the asset being leased and substantially all risks and rewards incidental to ownership, even though legal title may not be transferred.

Residual Value

The estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the age and in the condition expected at the end of its useful life.

Implicit Interest Rate

An interest rate inferred from the cost of borrowing, or the return on investment, that is not explicitly stated.

AASB 16

The Australian Accounting Standards Board standard on leases, which outlines the principles for recognition, measurement, presentation, and disclosure of leases.

Q11: If Country A has a comparative advantage

Q16: Consider a small firm that is producing

Q20: Refer to Figure 17- 3.The socially optimal

Q53: Refer to Figure 14- 2.In a perfectly

Q60: Of the following,which is the most important

Q67: A consumer maximizes his or her utility

Q69: Refer to Table 14- 1.In this labour

Q73: The excess burden of a tax reflects

Q82: When we consider any future stream of

Q84: Suppose taxes are levied in the following