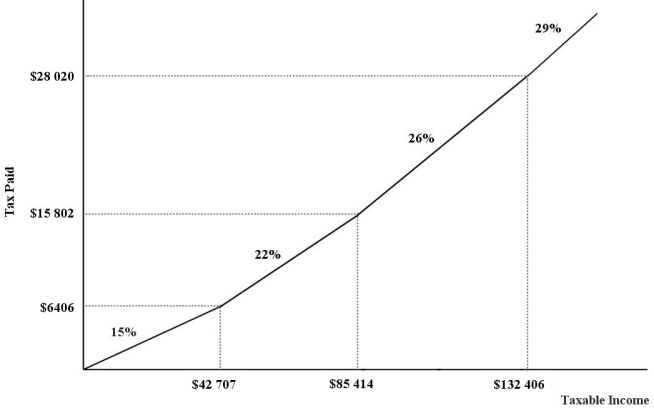

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.What must be true of the four marginal income- tax rates in order for the tax to be considered a "flat" tax?

Definitions:

Counterproductive

Having the opposite of the desired effect, often hindering or obstructing progress.

Meaning-focused Coping

Strategies that involve finding purpose or value in a stressful situation as a way to adapt and deal with the stress effectively.

Emotion-focused Coping

Strategies aimed at managing or regulating emotional responses to stressors rather than confronting the problems themselves.

Maladaptive Strategies

Behavioral or cognitive tactics that may provide short-term relief but are ineffective or harmful in the long-term.

Q29: Refer to Figure 16- 4.Once some quantity

Q33: One reason that national defence is a

Q39: The excess burden of an excise tax<br>A)is

Q52: The tax that generates the greatest proportion

Q54: The demand curve for a good with

Q54: The statement that introducing a policy of

Q63: The substitution effect of a price change

Q83: The concept of "trade diversion" refers to<br>A)trade

Q92: Services such as those within the justice

Q104: Refer to Figure 17- 5.Suppose Firm 1