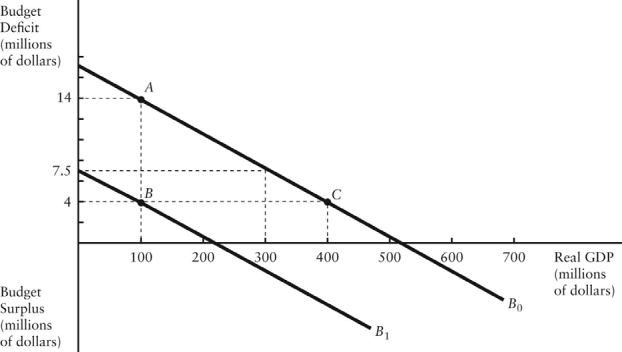

The diagram below shows two budget deficit functions for a hypothetical economy.

FIGURE 31-2

FIGURE 31-2

-Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function B0.Real GDP (Y) is $100 million.If the level of potential output (Y*) were $400 million,the structural budget deficit would be

Definitions:

Market Price

The current exchange price for an asset or service in the marketplace.

Discount Rate

The interest rate used to determine the present value of future cash flows or to discount future obligations.

Maturity

The predetermined date on which a financial instrument, loan, or security reaches its final payment, at which point the principal amount must be repaid.

Zero-Coupon Bond

A debt security that doesn't pay periodic interest, sold at a discount from its face value, and repays the face value at maturity.

Q12: A decrease in the money supply is

Q27: The budget deficit function is graphed with

Q46: The Bank of Canada establishes a rate

Q57: If,as market-clearing theories of the labour market

Q61: Monopolistic firms do not have supply curves

Q74: To reduce short-term market interest rates,the Bank

Q75: The overnight interest rate is crucial to

Q89: A straight- line production possibilities boundary differs

Q112: In mixed economies,economic behaviour is<br>A)largely determined by

Q166: Suppose there are only two countries in