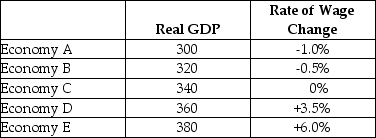

The table below shows data for five economies of similar size.Real GDP is measured in billions of dollars.Assume that potential output for each economy is $340 billion.

TABLE 24-1

TABLE 24-1

-Refer to Table 24-1.Which of the following statements best describes the situation facing Economy B?

Definitions:

Efficient Market

A concept where all available information is fully reflected in asset prices, making it impossible to consistently achieve higher returns than the overall market through stock selection or market timing.

Security Prices

The current market price at which a particular security can be bought or sold.

Superior Returns

Financial gains that exceed the average market return or benchmarks, often sought by investors.

Relative Strength

A momentum investing technique that compares the performance of a security or index to the overall market or a specific benchmark.

Q13: In general,if a central bank chooses to

Q20: Which of the following is a defining

Q32: Consider a simple macro model with demand-determined

Q41: Refer to Figure 23-1.Assume the economy is

Q42: Consider a simple macro model with a

Q43: In Canada,open-market operations are<br>A)government actions aimed at

Q45: Automatic fiscal stabilizers are most helpful in<br>A)making

Q50: Following any AD or AS shock,economists typically

Q60: Time lags in the conduct of monetary

Q72: Real GDP measures<br>A)the constant-dollar value of the