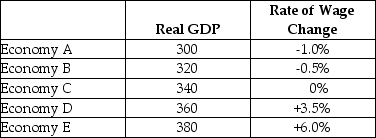

The table below shows data for five economies of similar size.Real GDP is measured in billions of dollars.Assume that potential output for each economy is $340 billion.

TABLE 24-1

TABLE 24-1

-Refer to Table 24-1.Consider Economy E.Which of the following best describes the positions of the aggregate demand and aggregate supply curves in this economy?

Definitions:

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments, not including cash equivalents.

Loans Receivable

Financial assets representing money lent by an entity to a third party, for which the lender expects repayment.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services delivered but not yet paid for.

Cash Equivalents

Short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

Q3: A commercial bankʹs target reserve ratio is

Q4: In our simple macro model with government,which

Q13: The Canada Deposit Insurance Corporation (CDIC)was set

Q18: Undesired or unplanned inventory accumulation is likely

Q40: Suppose Bank ABC has a target reserve

Q60: In the Neoclassical growth model,whenever diminishing returns

Q68: The money supply in Canada is measured

Q80: Refer to Table 20-3.What is the value

Q87: If the economy is currently in monetary

Q113: On a graph showing real national income