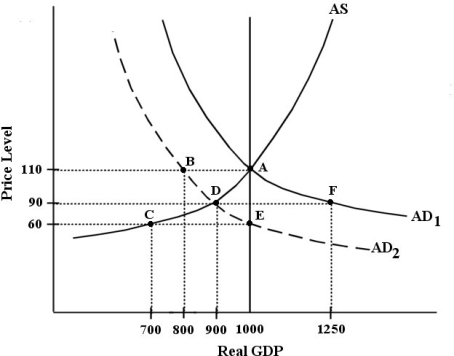

The diagram below shows an AD/AS model for a hypothetical economy.The economy begins in long-run equilibrium at point A.

FIGURE 24-3

FIGURE 24-3

-Refer to Figure 24-3.After the negative aggregate demand shock shown in the diagram (from AD1 to AD2) ,which of the following describes the adjustment process that would return the economy to its long -run equilibrium?

Definitions:

Break-even Sales

Break-even sales represent the amount of revenue needed to cover all fixed and variable costs, indicating the point at which a business neither makes a profit nor incurs a loss.

Break-even Sales

The level of sales at which a business generates revenue exactly equal to its costs, resulting in no profit or loss.

Consumer Division

A segment within a company focused on selling products and services directly to consumers, as opposed to business or commercial clients.

Break-even Sales

The amount of revenue needed to cover both the variable and fixed costs of a business, resulting in neither profit nor loss.

Q14: Consider a consumption function in a simple

Q19: Consider the long-run theory of investment,saving and

Q22: Consider a consumption function that is upward

Q27: An output gap with Y < Y*<br>A)is

Q31: If there are just two assets,bonds and

Q44: The Smith familyʹs disposable income rose from

Q73: The aggregate production function shows the _

Q85: If an economist supports targeting inflation as

Q95: Monetary policy will be least effective in

Q96: Consider the following statement about inflation targeting: