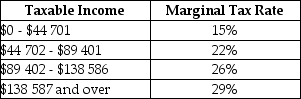

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $70 000,how much federal tax would be due?

Definitions:

Productivity

A measure of the efficiency of production, often assessed as the ratio of outputs to inputs in a production process.

Consumer Price Index

A measure that examines the weighted average of prices of a basket of consumer goods and services, often used as an indicator of inflation.

Pretzels

A type of baked bread product made from dough most commonly shaped into a twisted knot.

Cookies

Small pieces of data sent from a website and stored on a user's computer by the user's web browser while the user is browsing, often used to remember information about the user.

Q9: Which of the following statements is logically

Q31: Transfer payments made by the government affect

Q31: Refer to Table 13-4.A profit-maximizing firm will

Q42: Refer to Table 13-4.If plotted on a

Q43: Other things being equal,when the domestic price

Q48: When desired consumption exceeds disposable income, desired

Q73: Consider two families,each of whom earn total

Q79: Aggregate demand (AD)shocks have a smaller effect

Q80: A temporary factor-price differential is one which<br>A)will

Q102: Which of the following correctly describes the