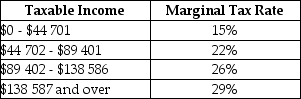

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the minimum rate of 15%?

Definitions:

Males

Refers to the biological and physiological characteristics that define humans as male.

Genetics

The branch of biology that studies genes, heredity, and variation in living organisms, explaining how traits are passed from parents to offspring.

Development

The process of change and growth throughout the life span, including physical, cognitive, and social-emotional aspects.

Uterine Wall

The muscular layer of the uterus that expands during pregnancy to accommodate a growing fetus and contracts during childbirth.

Q11: Refer to Figure 17-7.Suppose that a system

Q28: Suppose Canadaʹs exchange rate with the U.S.dollar

Q30: In terms of human capital,which of the

Q31: The following statements describe the adverse effects

Q37: Desired consumption divided by disposable income is

Q43: Refer to Figure 17-3.On the horizontal axis,the

Q64: Which of the following statements about the

Q81: Refer to Figure 17-5.Suppose each firm is

Q102: Refer to Table 13-2.Suppose this firm is

Q115: Suppose a firm producing roof shingles imposes