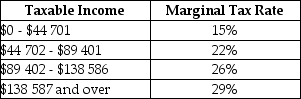

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 26%?

Definitions:

Competitive Advantage

A condition or circumstance that puts a company in a favorable or superior business position compared to its competitors.

Recruitment

The process of identifying, attracting, and hiring suitable candidates for jobs within an organization.

Nonmandatory Major Benefit

A significant employment perk that is not legally required but is offered by an employer to attract or retain employees.

Canadian Organizations

Entities based in Canada, functioning across various domains, including non-profit, governmental, and business sectors, adhering to Canadian regulatory and cultural standards.

Q4: In our simple macro model with government,which

Q10: If the economyʹs AS curve is very

Q13: Undesired or unplanned inventory decumulation is likely

Q18: Consider a simple macro model with a

Q32: Economists often argue that a system of

Q38: Refer to Figure 17-2.The net social benefit

Q48: One possible reason for wage differentials is

Q72: Real GDP measures<br>A)the constant-dollar value of the

Q84: Consider a firmʹs demand curve for labour.If

Q93: Consider the nature of macroeconomic equilibrium.If,at a