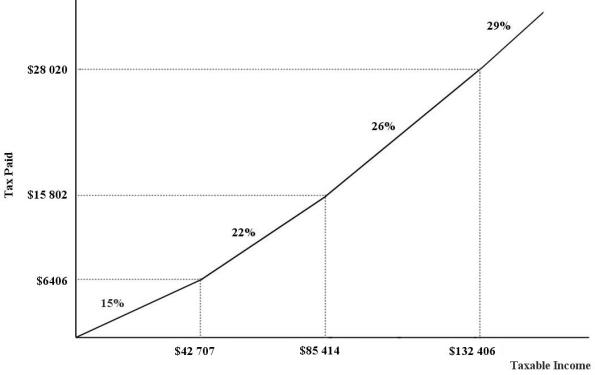

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $98 125 will pay $________ in income taxes.

Definitions:

Low Motivation

A lack of desire or willingness to engage in activities or pursue goals, often resulting in reduced productivity or achievement.

Initial Interview

The first meeting between a clinician and a client/patient, aimed at gathering relevant history and presenting issues for assessment.

Family History

The record of diseases or medical conditions present in an individual's immediate and extended family.

Bender-Gestalt Test

A psychological assessment used to evaluate visual-motor functioning and neurological impairments by having subjects draw certain figures.

Q12: Consider the governmentʹs budget balance.Suppose G =

Q35: In Canada,as in many other countries,the largest

Q39: Refer to Figure 18-4.What is the value

Q42: Suppose Honest Robʹs Used Cars buys a

Q50: If nominal national income increased by 20%

Q63: Consider the investment component of GDP.The change

Q68: A parallel downward shift in the net

Q68: Aggregate supply refers to the<br>A)decisions of firms

Q71: Refer to Figure 13-2.This factor market is

Q89: If the Consumer Price Index changes from